Have you ever wanted to buy something, but didn’t have the money to cover its total cost at once? In such cases, apps like Affirm come in handy.

Affirm allows you to split your payment into four parts or get a loan for your payment, which you can pay back over many weeks or months. This is called “Buy Now, Pay Later,” or BNPL.

There are several companies like Affirm that offer similar services, namely Splitit, Sezzle, Afterpay and others. Though the best company like Affirm is Klarna. Besides offering attractive BNPL options, there are plenty of store choices on Klarna. You also get rewarded every time you make a purchase.

Why look for Affirm alternatives?

The problem with Affirm is that it isn’t available in all stores. Furthermore, if you don’t have a decent credit score, you may not qualify for an Affirm loan.

Not only that, but Affirm charges interest rates on long-term loans, with an APY of up to 30%, depending on your credit score. Other competitors charge less or don’t require as high of a credit score to qualify for the program.

Whether you were unsatisfied with Affirm due to the reasons stated above, or you are simply curious about other alternatives out there, read on. Today, I will show you the 12 best companies like Affirm.

Also Read: Best Cash Advance Apps Like Dave

Best Companies Like Affirm

1. Klarna

Klarna is an excellent alternative to Affirm.

Affirm only has two options: Either you split your payment into four installments, with the first one due right away, or you apply for a loan that you can pay over 6-12 months, with varying interest rates.

However, Klarna offers three options.

The first is to split your payment into four, with the first installment due right away and the other three payments due at two-week intervals.

The second option is to sign up for monthly financing. Different lengths are offered by different stores, depending on the cost of your purchase, but they go up to 36 months.

Interest rates at Klarna vary and depend on your credit score. However, the highest it will go is 24.99%, which is lower than Affirm’s highest interest rate (30%).

Finally, the third option is to buy right away and pay the full amount in 30 days, which is an option that Affirm does not offer.

The first and second options are useful when you want to buy something and are expecting a paycheck to roll in, so you know you can afford it. However, you want to leave enough money in your bank account for emergencies.

The third option is useful when you don’t mind spending a lot at once, but you are waiting for a payment to land in your bank account. Alternatively, it’s helpful if you are purchasing something that allows for free returns within 30 days, and you are not yet sure whether you will decide to keep or return it.

In general, Klarna works with different stores than Affirm, so download the Klarna app and browse available shops.

And, while Affirm has a cashback program, Klarna has a rewards program that gives you one “vibe” for every dollar spent. You can accumulate vibes and exchange them for rewards.

Another reason to choose Klarna: When you make your first purchase, you’ll get a $5 bonus.

Check out similar apps like Klarna here.

2. PayPal

If you have a PayPal account, it’s one of the best alternatives to Affirm. Many companies accept PayPal as a payment method.

The cool thing about PayPal is that as long as you are paying with PayPal, you can benefit from its payment splitting features. A lot of companies, including some airlines and major marketplaces like eBay, support the PayPal “Buy Now, Pay Later” program.

eBay doesn’t include native support for Affirm. However, using PayPal on eBay, you can purchase electronics, clothing, and a lot more and pay for it over time!

There are actually two options on PayPal. The first is to split your payment into 4 installments, with the first one due the date of the purchase and the other three due at two-week intervals.

Even if you don’t qualify for Affirm, you may still qualify for PayPal Pay In 4. You don’t even need to have money in your PayPal account; PayPal can take the installments from a linked bank or debit card.

You can always pay your Pay In 4 balance in full at any time, earlier than your due date.

The downside of using PayPal is that you may not be able to have more than one Pay In 4 installment plan active at a time.

The second option is to sign up for PayPal Credit. Again, PayPal may be more lenient than Affirm, and many people with poor credit scores still qualify.

PayPal Credit allows you to pay for your purchase over six or 12 months. You’ll make monthly payments with interest rates as low as 0%.

However, PayPal Credit and PayPal Split In 4 are only available in the United States, not Canada.

Also Read: Best Apps Like Albert

3. Splitit

If you don’t qualify for Affirm due to a terrible credit score, Splitit is the best alternative. Unlike Affirm, it doesn’t require a credit check, so you can use it even if you have zero or poor credit!

That’s because it uses the balance on your existing credit card. Even if you have a poor credit score, you can still open a secured credit card or another credit card that accepts people with poor or fair credit.

Once you have available credit on your card, you can use Splitit. Furthermore, Splitit doesn’t charge interest.

When you use Affirm, you will also lose out on your credit card points. For example, your credit card might give you a point for every dollar you spend, but you won’t earn any points if you use Affirm instead of your card.

Splitit allows you to keep your credit card points! You can have your cake and eat it too.

Splitit also never charges for late fees, and it never charges interest, unlike Affirm (though you will have to pay your credit card issuer interest).

So, how does Splitit work? It’s pretty simple.

Let’s say you want to purchase something that costs $300 and pay it off over six months. Splitit will put a pre-authorization hold on your credit card for $300.

Every month, when you pay $50, Splitit will release the previous authorization and make a new one. For example, it will make a hold of $250 a month, a hold of $200 the next month, a hold of $150 the next month, and so on.

The good news is that you can use any credit card, as long as it’s a Mastercard, Visa, Discover, or Union Pay card. The bad news is that you can’t use a debit card.

If you have poor credit or no credit at all, Discover has a secured credit card that allows you to start a credit line equaling the amount of your refundable security deposit. You can even earn 1-2% cash back on all purchases.

Also Read: Best Privacy.com Alternatives

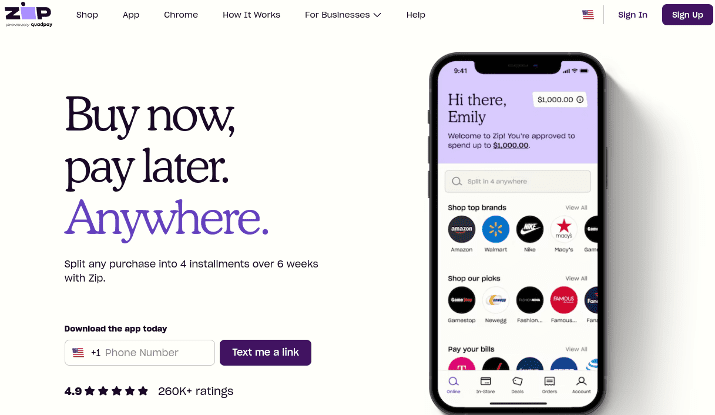

4. Zip

Zip, formerly QuadPay, is another superb alternative to Affirm. It will give you a virtual Zip Visa debit card you can add to Google Pay or Apple Pay, which allows you to shop anywhere and pay in installments of four.

One downside of using Zip is that it comes with a $7.95/monthly account fee, which is waived if you have no balance due. However, it supports websites that Affirm does not, like Airbnb – making it perfect for vacation lovers.

Furthermore, if you own a business, you may find Zip easier to set up. On G2, users ranked it better than Affirm in all categories, including customer support and ease of setup.

Check Out: Best Sites Like Etsy

5. Sezzle

Sezzle is another BNPL company. It’s a fantastic alternative to Affirm because while Affirm doesn’t let you change your payment date once you’ve set it up (even though it doesn’t charge late fees), Sezzle does.

In fact, Sezzle won’t even charge you for changing your payment date – you’re allowed one free due date reschedule per order, allowing you to reschedule your payment date up to two weeks later.

In some states, you can reschedule your payment date a second and third time, but it will cost you a fee those times around. Again, Sezzle will give you a two-week rescheduling window.

Sometimes, you might set up a payment plan because you are expecting a paycheck, but your boss gives it to you a few days later than you expected, or your bank takes longer than normal to process your direct deposit. In those cases, Sezzle can really come in handy, as you can change your due date.

Also, if you’d like to support black-owned businesses, it currently has a section on its website dedicated to such stores, which Affirm is lacking.

When you use Sezzle, you will be able to split your payment into four. You’ll make the first payment right away and the other three payments over the next six weeks.

There will be no impact on your credit score, nor will you have to pay interest. If you pay on time, there will be no added fees.

Over 47,000 businesses are available on Sezzle. It may add more later.

6. Afterpay

When using Affirm and other BNPL companies, it’s easy to accidentally spend more than what you can afford. People who have poor budgeting skills or a lack of money management control can easily find themselves going into debt.

Yes, people with poor money management skills can sometimes have excellent credit and be approved by Affirm.

Afterpay aims to fix that problem by starting all users off with a spending limit of around $500-600. Furthermore, your first payment must be made upfront.

That way, Afterpay can take its time to determine whether you are a responsible spender. Once it realizes that you are, it will increase your spending limit.

If you’re worried about losing control and shopping for stuff you don’t need when using Affirm, consider Afterpay as an alternative.

Also, Afterpay lets you reschedule three payment dates per year. You can lengthen your repayment date by up to five days each time – Affirm doesn’t allow users to reschedule payment dates.

7. Uplift

For travel, Uplift is a better option than Affirm. Affirm does support some travel websites, such as CheapOair, Just Fly, Alternative Airlines, Priceline, and others.

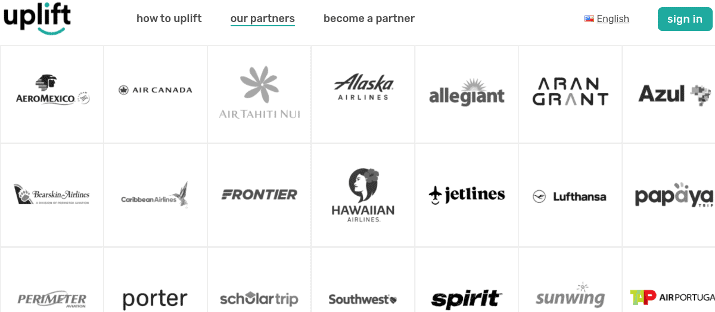

However, you will notice that most of the travel sites that support Affirm seem to be third party booking sites. Uplift offers a wider variety of airlines that support it, allowing you to purchase from the airlines directly.

I noticed that Uplift focuses exclusively on the travel sector. It’s not limited to airlines, though; you can also book cruises, hotels, vacation packages, and more.

When you check out with Uplift, you will be able to pay over many months – in that sense, it’s similar to Affirm in that it’s not just a “Split in 4” company.

Nevertheless, due to the fact that it focuses only on travel, it’s able to offer partnerships with more airlines. Some airlines that you can buy from using Uplift include:

- Alaska Airlines

- United

- Allegiant Air

- American Airlines

- Hawaiian Airlines

- Lufthansa

- Canada Jetlines

- Southwest

- Spirit

- Sunwing

- Volaris

- TAP Air Portugal

- Caribbean Airlines

- Air Canada

- AeroMexico

- Azul Airlines

- Bearskin Airlines

- Air Tahiti Nui

- And many others

As you can see, whether you want to book a domestic flight to Florida or an international flight to the Caribbean, Europe, the Pacific, or elsewhere, Uplift allows you to book your vacation and pay it off over many months.

While some of these airlines may be available on Affirm or other BNPL companies, others seem to work exclusively with Uplift.

Do you want to take your significant other on a trip for their birthday, but you don’t have the money to do so right now? Uplift is the best choice for you.

You may be wondering why you would want to use Uplift to purchase from the airline directly instead of using Affirm to purchase from an online travel agent like Priceline.

The reality is that purchasing from the airline directly is always superior. Airlines typically have more flexible cancellation and change policies, as well as perks like free seat selection and baggage (depending on the fare rate).

Third-party sites like CheapOair often sell tickets for cheaper. However, they tend to charge more for cancellations, changes, and other perks, and the airline won’t be able to cancel for you if you purchase from a site like CheapOair, which has a 1.2-star rating on Consumer Affairs.

Furthermore, online travel agents are not bound by the same regulations as airlines. For example, airlines must offer free cancellation for 24 hours or a price hold option on all flights going to and from the United States.

That gives you a lot of flexibility. You can book a flight with Uplift and have 24 hours to decide whether you want to go into debt or not for it.

However, while some online travel agents also offer that option, they are not actually required to do so, according to USA Today.

So, if you need an Affirm alternative for travel, I recommend Uplift.

8. MarcusPay

MarcusPay is offered by Goldman Sachs. It’s a good alternative to Affirm if you want to book a vacation with JetBlue.

It seems like JetBlue is the only company that supports MarcusPay, but you can book both flights and vacation packages. However, you can’t use Affirm to pay for JetBlue, so there’s that.

MarcusPay gives you a full month before your first payment is due, and you can take your trip before your balance is paid in full. You can use it for payments starting from $300 and going up to $10,000, with fixed interest rates.

9. Bread Payments

Bread allows you to split your purchase, whether you made it online or in a store, into four payments or pay it off over many months. According to Lending Tree and other online sources, Bread allows you to take out a loan for purchases of up to $20,000 – that’s higher than Affirm’s limit of $17,500.

10. LutherSales

While Affirm may report your payment history to the credit bureaus, it’s not a guarantee. So, while Affirm might be a nice way to avoid spending a huge chunk of money at once, it’s not necessarily the best choice if you want to build credit.

Enter LutherSales. According to LutherSales, besides being a BNPL company, it also helps users build credit by reporting to the major credit bureaus.

Furthermore, you can get an appointment to discuss your shopping plan with a personal shopper. LutherSales is always running deals on furniture, phones, and other items, and it has excellent reviews on TrustPilot.

11. Zebit

Zebit is an online marketplace that has a built-in BNPL feature. It’s designed for people who don’t have great credit, making it an awesome place to shop if you didn’t get approved for Affirm.

You can get a credit limit of up to $2,500. There is a decent selection of products, including products from around 1,500 brands, including top ones like Samsung and Apple.

Zebit allows you to pay over the next six months. Here’s the cool thing – your payment plan varies based on how often you get paid.

As such, you might pay installments every month, every two weeks, or every week.

You’ll also need to make a down payment, which will usually be 20-30%.

Even though you don’t need excellent credit to be approved for Zebit, not everyone will qualify. While Zebit doesn’t look at your FICO score, it does look at other factors from the credit reporting agencies to determine how financially responsible and stable you are.

If you’re wondering whether Zebit is legit, don’t! It has an A+ rating with the BBB and is totally legit, according to The College Investor.

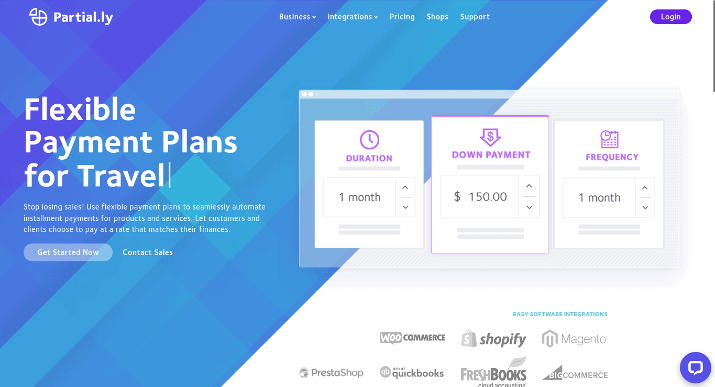

12. Partial.ly

Partial.ly is an ecommerce plugin that allows businesses to offer payment plans on their ecommerce stores. It integrates with Magento, WooCommerce, Shopify, and others.

There are many Shopify and other ecommerce stores that offer payment plans via Partial.ly. However, as a small business owner, Partial.ly allows you full control over terms, payment frequency, minimum down payments, and more.

Not every business will be eligible to work with Affirm, so consider checking out Partial.ly instead. It has useful plugins and apps for different ecommerce platforms.

Partial.ly is also good for freelancers who work with clients and would like to set up streamlined payment plans.

Is BNPL Good? Pros & Cons

Buy Now, Pay Later has many benefits, which I already explained above. It allows you to buy things you need or want, even if you don’t have all the cash on hand right now.

Furthermore, BNPL can be a smart decision at times. For example, if you really need something that costs a lot of money, paying for it all at once might cause you to be out of cash for a while.

Emergencies can happen all the time, so it’s never a good idea to have very little cash to your name. If you know you will get a paycheck soon, or if you can get a refund within 30 days of your purchase, BNPL might be a smart financial decision.

On the other hand, BNPL can also cause you to spend money that you don’t have. If your cash flow situation doesn’t allow you to make a significant purchase, perhaps you are not in the financial position to make it.

In that case, you might be better off not purchasing that thing you want instead of using BNPL to finance it.

Also, remember that being late on your BNPL payments may cause your credit score to go down, which can have long-lasting effects.

In short, BNPL is awesome, but be smart about it! Know your limits.

Wrapping It Up: What Is The Best Company To Affirm?

Klarna is the #1 company like Affirm.

Besides offering three useful BNPL options, it has a massive selection of stores to choose from and a robust rewards program that will help you save money when you shop.

Ben Levin is a Hubspot certified content marketing professional and SEO expert with 6 years of experience and a strong passion for writing and blogging. His areas of specialty include personal finance, tech, and marketing. He loves exploring new topics and has also written about HVAC repair to dog food recommendations. Ben is currently pursuing a bachelor’s in computer science, and his hobbies include motorcycling, Brazilian Jiu-Jitsu, and Muay Thai.