Buy now, pay later services are becoming increasingly popular. This is because they offer shoppers a convenient way to pay for items over time. Sezzle is one such platform that offer these services.

Sezzle provides a payment platform allowing shoppers to pay for items in installments. It splits the cost of an item into four interest-free payments. These payments are spread out over six weeks.

Besides Sezzle, similar BNPL services exist such as Afterpay, Klarna, Zip and many others. However, the best Sezzle alternative is Affirm. This is because the platform is 100% transparent and conceals nothing when it comes to user policies.

More about Sezzle and why explore alternative platforms

Sezzle is available at over 10,000 online stores. Some of the most popular Sezzle stores include Gamestop and Target.

One of the biggest advantages of Sezzle is that shoppers can spread the cost of an item over time without paying any interest.

This makes it a great choice for anyone who wants to pay for their purchases over time without having to worry about interest charges or other fees associated with using a traditional credit card.

Well, despite all of Sezzle’s amazing benefits and the many stores that accept it, there are some situations where shoppers may want to consider using a different buy now, pay later service.

For example, some shoppers may prefer a different payment plan or be looking for an option that is eligible for cashback rewards.

Also, Sezzle applications that are denied can get a refund and move on with another payment option, so even if you’re rejected at Sezzle, it’s very likely that you’ll have success with one of these best Sezzle alternatives.

Whatever the reason, shoppers have plenty of excellent Sezzle alternatives to choose from.

Take a look what we have on our list.

Best Sezzle Alternatives

1. Affirm

Affirm is a payment option that offers shoppers the ability to pay for items in installments.

It operates like a financial institution, meaning that it offers lines of credit to shoppers.

Unlike a credit card, Affirm does not charge compounding interest on the unpaid balance.

Affirm also offers the ability to pre-qualify for a loan, so shoppers know exactly how much they can spend before they start shopping.

This can be helpful for those who want to purchase a high-priced item but don’t have the funds available to do so all at once.

Additionally, Affirm doesn’t charge any additional interest on installment payments, making it just like Sezzle.

Although Affirm doesn’t offer some of the same shopping options that Sezzle does, its transactions do appear on your credit report, which is beneficial if you’re looking to build or improve your credit history and score.

The maximum purchase amount that can be financed through Affirm is typically around $17,500, but some shoppers have been able to work with the company if they need to finance a higher purchase amount.

Whenever you make a purchase, Affirm examines your credit history to approve the transaction.

The company then sends you different payment options to choose from depending on your limit.

Your credit limit is determined by your credit history, payment history, and how long you have had your Affirm account.

You can choose to repay your Affirm loan over three, six, or twelve months.

The company also offers the ability to make early payments without any penalties.

Additionally, if you miss a payment, there’s also no penalty fee, however, your credit limit will be reduced.

2. Afterpay

Afterpay is an Australian company that offers the same type of service as Sezzle. Afterpay is available in Australia, New Zealand, and the United States.

Like Sezzle, Afterpay allows shoppers to make purchases and then pay for them in installments, interest-free. Plus there is no credit check required to use Afterpay.

To create an Afterpay account, shoppers simply need to provide their email address, phone number, and a credit or debit card.

After which, the app generates a spending limit which is typically around $500. This limit can be increased after a while by making on-time payments.

You will have to pay 25% of the total purchase price upfront and then the remaining balance in three installments that are each due two weeks apart.

For example, if you make a purchase of $1000, then you would need to pay $250 upfront and the remaining payments of $750 in installments over the next three weeks.

While there is no interest to be paid on your purchases, a late payment fee will be charged if you don’t make a payment within the allotted time frame.

You also risk being turned down for future Afterpay purchases if you miss a payment. However, they will not report to credit agencies, so it won’t hurt your credit score.

3. Klarna

Another great payment option similar to Sezzle is Klarna.

With Klarna, shoppers can make direct payments or split their purchases into installments.

You will be able to purchase from any US retailer that accepts credit cards using Klarna as your payment method.

Klarna is especially useful for online purchases, as you can pay off your items in installments without leaving the comfort of your home.

Like Sezzle, Klarna offers great installment payments with no upfront costs and no hidden fees.

Using the app provides a seamless experience that is hard to match. To sign up, you will only be required to provide a few basic personal pieces of information and you are good to go.

The app will then perform a soft credit check, which will not impact your credit score.

Once you make your purchase, you can select from up to three financial options: Pay in four days, pay in 30 days, or pay in 6 – 36 months.

The pay in four days option is interest-free and great for small purchases. It requires a 25% down payment.

The pay in 30 days option is also interest-free, as long as you pay off your purchase within the grace period. It also gives you enough time to return items, if necessary.

The 6 – 36 months option demands you to make monthly payments until you have cleared off your debt.

4. Zip

Zip acquired Quadpay in March 2020, making it one of the largest installment payment providers.

It offers in-store and online installment plans in countries like the U.S., Canada, Australia, and the UK.

Users can choose from two types of interest-free accounts Zip Money and Zip Pay.

Zip Pay gives you an interest-free ceiling till the end of the month. If you can’t pay it off by then, you will be charged a fee of $6.

On the other hand, if you want to pay in monthly installments, you can use Zip Money. This type of financing offers an interest-free period of up to six months and can lend you up to $30,000 in credit.

You will need to create an account providing your personal information like name, email, address, date of birth, a government-issued ID card, and phone number.

You can search for a store that accepts Zip payments or browse through the online store directory.

Once you choose your store, add items to your cart, and at checkout, select Zip as your payment method.

Also Read: Best Sites Like FlexShopper

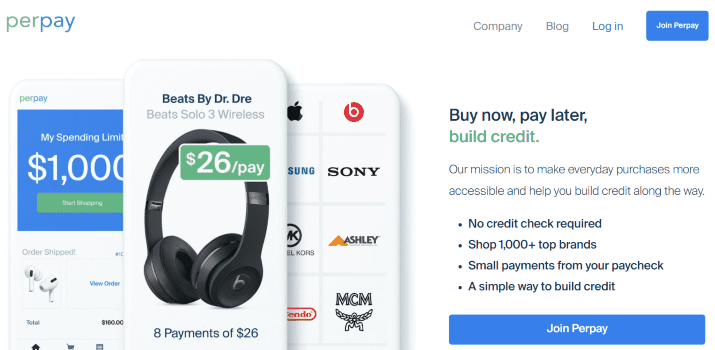

5. Perpay

Perpay is a great Sezzle alternative because it offers many of the same benefits. For example, both Perpay and Sezzle allow shoppers to pay for items in installments. In addition, both companies offer interest-free financing plans.

However, there are some key differences between the two companies. For one, you can use Perpay to build your credit score.

You are only eligible for this after you make successful on-time payments for four months. Then Perpay will report your payments to the credit bureaus.

Perpay partners with around 200 retailers as of now but it is likely to grow in the future.

You can explore products on Perpay and add them to your cart. Then you can submit an application to see if you’re approved for financing.

If they approve your application, you will generate an email detailing the terms of your financing. If you agree to the terms, you can start making payments.

After you make your first payment, they will ship the goods to you and from then on, you’ll make payments according to the schedule set forth in your email.

While Perpay doesn’t charge interest, they do have a penalty for late payments. If you make a late payment, you will be charged a fee of up to $35.

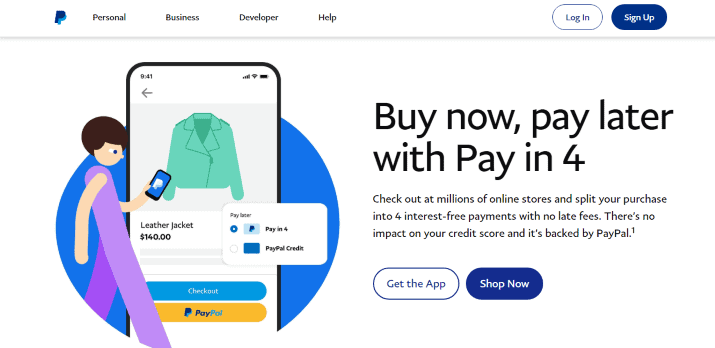

6. PayPal Pay in 4

PayPal is probably one of the most well-known payment options on this list.

The Pay in 4 program is a new BNPL service from PayPal that offers installments on eligible transactions.

Meaning that if you have a PayPal balance that reads negative, you may not qualify for the Pay in 4 program.

With PayPal, shoppers can pay for items in four installments at no extra cost to them.

This makes PayPal an ideal option for shoppers who want to enjoy all the benefits of Sezzle without actually using Sezzle’s services. Another benefit of PayPal is that it’s widely accepted, so shoppers can use it at many online retailers.

PayPal leverages its own information to determine a consumer’s creditworthiness. They also run checks on external credit bureaus to determine whether a consumer is eligible for their Pay in 4 program.

The Pay-in-4 option button would show on your PayPal account if you’re eligible.

Like Sezzle, you can pay in four installments for purchases between $30 and $1500.

The first payment is due when you make the purchase and future payments are delivered subsequently.

Also Read: Best Apps Like Albert

7. Splitit

Splitit is a relatively new payment option that allows shoppers to pay for items in installments.

It lets you make payments with an existing credit card as Sezzle does.

Merchants of all sizes can use Splitit to provide instant financing to their customers.

You will find some famous sellers using Splitit like SofaClub. While it is not as widely available as Sezzle, it is growing rapidly.

You can arrange payments over 3, 6, 9, 12, or 24 months and there are no interest charges whatsoever.

Unlike Sezzle, it doesn’t require any registration, so it might be a good option for those who are turned off by the idea of sharing their personal information.

Splitit also does not do a credit check, so if you are worried about your credit score, this could be a good option for you.

You can set up an account on the support portal to use to check your balance, make payments, and see your payment history.

Check Out: Best Quicken Alternatives

8. Venue

Venue is a top Sezzle alternative that is used by online shoppers all over the world.

One of the biggest benefits of Venue is its robust payment options, which give consumers more flexibility when it comes to buying items.

Another advantage of Venue is its fast and easy checkout process, which makes shopping on the platform even more convenient.

Customers can choose from over one million different brands when shopping on Venue, which is one of the most comprehensive selections available.

Plus, Venue offers a variety of shipping and delivery options to ensure that shoppers can get their items as soon as possible.

If you pay $50 during shopping, you can get your item on the same day, otherwise, you can accept a leasing arrangement that lets you make a specified payment until the product is yours. This option is not available on Sezzle.

With this option, you can send back an item if you no longer want it or you are not able to pay for it anymore as long as it is still in good condition.

Unlike Sezzle, you must have at least $1000 in your checking account balance to be eligible for this option.

Explore: Cash Advance Apps Like Dave

9. Shop Pay by Shopify

Shop Pay is owned by Shopify, a popular eCommerce platform that enables businesses to set up and operate their own online stores.

It is a payment option available for merchants who sell on Shopify platforms.

The platform offers a one-click payment solution for customers and is available in 18 countries.

Interestingly, Shop Pay doesn’t only work on Shopify platforms. As long as the merchant enables it, customers can use Shop Pay on any website.

One of the benefits of using Shop Pay is that it offers a smooth and seamless checkout experience for customers.

Perhaps the most interesting thing about it is that shoppers can either pay in full or use Shop Pay’s installment feature to pay over time, just like it is on Sezzle.

Here’s how it works:

- Customers select the items they want to buy and add them to their carts.

- They choose Shop Pay installment as their payment method at checkout and complete the order.

- The customer then makes their first payment with their credit or debit card and saves it for future installments.

- Shop pay then runs an identity verification process to ensure that the customer is who they say they are.

- After the verification process is complete, the customer agrees to the terms and authorizes Shop Pay to debit their accounts for the remaining payments.

Shop Pay doesn’t charge for late or missed payments, however, you risk getting locked out of the program if you miss too many payments.

Also Read: Best Apps Like Chimebank

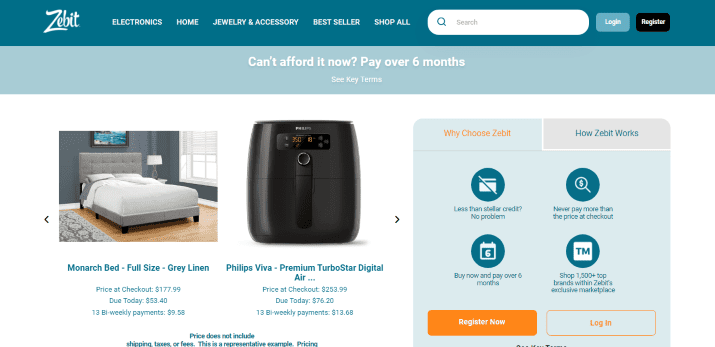

10. Zebit

Zebit is a great Sezzle alternative for shoppers who want to avoid interest and fees.

Zebit provides customers with a Zebit line of credit, so they can easily make purchases online without worrying about interest or fees.

This credit line will be based on the salary that you make, up to the tune of $2500.

Zebit has an arrangement with employers to provide the payroll information of their workers so that they can extend Zebit’s line of credit.

The company also has a wide network of merchants and retailers who can accept payments through the Zebit platform.

If you shop with Zebit, you’ll have access to affordable financing options as well as secure online shopping.

Once you choose an item via Zebit, you will need to make a down payment of 25% before the item can be shipped.

If you don’t make the down payment, the item will not be released until you do.

You can make subsequent payments over the next six months. You can also pay the item off early with no penalty.

Zebit doesn’t affect your credit score but it’s advisable to pay the money back when due to avoid rescinding your credit line.

Explore the best sites like Zebit here.

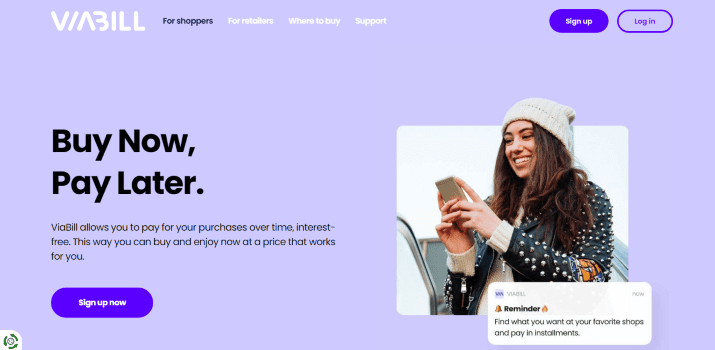

11. ViaBill

ViaBill is a payment option that allows shoppers to pay for items in installments. ViaBill offers the same or similar benefits as Sezzle, including the ability to split payments over time and avoid interest charges.

They charge a late fee of $15 if a payment is missed. This is one of the means of revenue generation for the platform.

To use ViaBill, you need to head over to a website or store that uses the platform. When you check out using ViaBill, the platform will deduct the down payment from your card.

The approval process does not take long and happens during the checkout process.

Like Sezzle, ViaBill does affect your credit score as they use a soft credit check.

Also Read: Best Fashion Websites

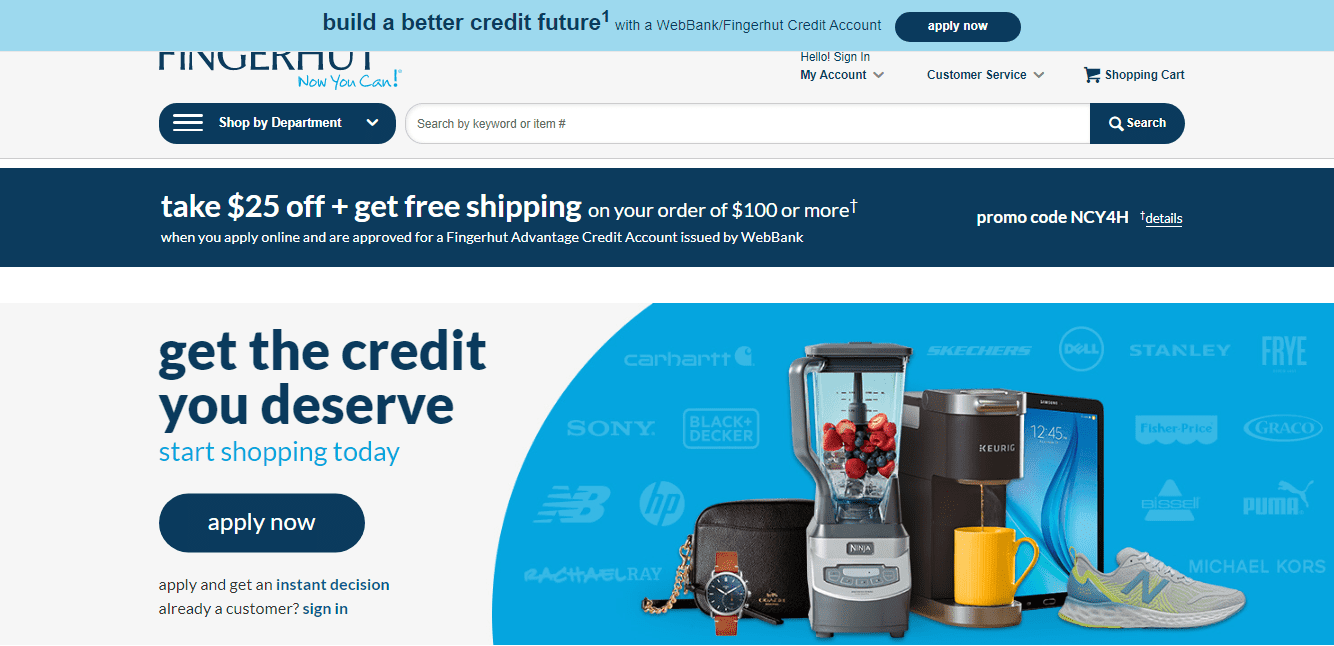

12. Fingerhut

Fingerhut is a retailer that offers a wide variety of products including electronics, home goods, and clothing.

They offer a financing program that allows shoppers to pay for items in installments. This program is similar to Sezzle in that it allows shoppers to spread out their payments over time.

Fingerhut also offers a no-interest payment plan, which is a great alternative to Sezzle’s similar non-interest-based payment plan.

The app does not review your credit history to get approved, so it is ideal for shoppers with low credit scores.

On the other hand, you can use it to boost your credit score by making on-time payments directly through the company’s website or from their partners.

13. FuturePay

When it comes to Sezzle alternatives, FuturePay is one of the most popular options.

It is a digital credit service that allows shoppers to purchase items online and pay for them in monthly installments.

The platform uses its proprietary checkout process, which allows users to choose their account type and enter personal information such as their name and phone number.

Buyers get approved in seconds and can make their purchase immediately. They don’t need credit cards and can shop at any store that accepts FuturePay for items for as small as $25 and more.

14. Amazon

Some people might argue that Amazon isn’t technically a Sezzle alternative, but it does offer many of the same benefits.

With Amazon’s pay-in-full option, you can choose to split your payment into one or more monthly installments and enjoy the convenience of paying over time.

This is especially useful for larger purchases like appliances, computers, and furniture that may require several months to pay off.

Another benefit of using Amazon is that they often offer promotions and coupons that can help you save money on your purchases.

Like Sezzle, it is also interest-free, although not all items on Amazon are eligible for this offer.

For eligible items, you will have to make a down payment of 20% of the item price, which is automatically applied at checkout.

The subsequent balance will be paid over the course of the next four months, with payment due at the end of every month.

15. Four

Four is a new kid on the block when it comes to interest-free installment plans.

It offers a similar service to Sezzle in that it allows shoppers to pay for items in four installments over six weeks.

The payments are split into four equal payments that are processed bi-weekly.

There is no credit check required and no hidden fees. However, users will be required to make a down payment of 25% when they sign up for an account.

Credit is approved instantly and it has no impact whatsoever on your credit score.

Check Out: Best Privacy.com Alternatives

Wrapping up

All the alternatives to Sezzle that we have looked at offer great payment options for shoppers. While some may be better suited for certain types of purchases, all of them provide a great way to spread out the cost of items.

For us, our top pick is Affirm which offers a great way to finance your purchase with clear terms and no hidden fees.

However, no matter which option you choose, you are sure to find a great way to finance your next purchase.

Tom loves to write on technology, e-commerce & internet marketing.

Tom has been a full-time internet marketer for two decades now, earning millions of dollars while living life on his own terms. Along the way, he’s also coached thousands of other people to success.