Zebit is one of the sites that offer Buy Now, Pay Later payment services. The platform allows you to browse and purchase up to 2500 dollars in interest-free credits on the go.

Besides Zebit, you can find several other BNPL services in the market such as Afterpay, Perpay, Affirm and others. However, the best site like Zebit is Klarna which also provides seamless payment solutions to people in the eCommerce industry. It also has an excellent mobile app which makes tracking all aspects of your shopping easier.

More about Zebit and the need to explore alternatives

Zebit is known for offering high-quality goods. You can quickly register for free and provide all your information to purchase any services or products.

Its payment plan is spread over six monthly installments. It’s noteworthy that there is no interest or late fees.

There are various interactive modules on the site, a fantastic encryption layer for quick and safe usage, and a newsletter tool that sends emails to your email address about different schemes.

Zebit’s intuitive user interface provides a full view of every item associated with the brand on a system-wide basis. Only users over the age of 18 are permitted to evaluate the platform and read its material, thanks to the company’s special terms and conditions certificate.

Despite all the plus points, Zebit has certain disadvantages, including the fact that it charges its consumers for shipping and handling. Second, the company’s items are quite expensive. It’s also important to understand that there are no returns or refunds.

To be authorized for credit, you must have some source of income. If you do not currently have a source of income, you will not be eligible for credit with Zebit.

That prompts us to check out sites that are similar to Zebit. Down below, we have listed some of the best alternatives to Zebit. Take a look.

Best Sites Like Zebit

1. Overstock

Overstock is an American online shop that mostly offers furniture. Compared to Zebit, Overstock is a top site that can assist you in finding designer brands and home products at the lowest possible cost on the internet.

The firm sells fresh merchandise in addition to furniture, home décor, bedding, handmade goods, and a variety of other items.

Overstock is also in charge of managing the inventory supply for third-party sellers. Initially, the group sold overstocked items solely and returned items on an online eCommerce marketplace, settling the inventory of at least 18 failing dot-com enterprises at less than wholesale.

Overstock is only available to those 18 years old or older who have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) and have a valid credit or debit card.

Unlike Zebit, Overstock comes with two distinct financing options: the Overstock Store Credit Card and the Lease-to-Own program. Consumers may pay off their OverStock Credit Card balance in full for up to 24 months with no interest.

This BNPL platform does not charge interest, application fees, or processing fees for its product.

2. FlexShopper

FlexShopper is another Zebit alternative. FlexShopper has approximately 100,000 new brand-name goods available for purchase every month.

All of the items are purchased from reputable merchants. You’ll see the cost of leasing each product every week. The weekly payments are based on a 52-week lease and you may be eligible for a spending limit of $2,500.

To use it, you can either download the FlexShopper web browser or the app from the Apple App Store or Google Play Store.

Suppose you want to be considered for a FlexShopper loan. In that case, you must be at least 18 years old, live in the United States, have a legitimate bank account, a valid Social Security number, a phone number, an address, and have a steady source of income.

Even though it does not charge interest on your purchases, late penalties may apply if your payment is not received on time.

If you have a problem with FlexShopper, you can contact them by email.

Find out more sites like Flexshopper in this post.

3. Afterpay

Afterpay is available in the United Kingdom, the United States, Canada, Australia, and New Zealand, among other countries and regions.

It is well-known for its “pay later” option, enabling in-store and online customers to instantly purchase a product and pay later in four equal installments without incurring additional fees or penalties.

Unlike Zebit, It is completely linked with your favorite online retailers. Users making their first purchase can proceed as normal, providing payment information, and the vendor will then send the items to you.

Access your account at any moment to view your payment plan and make payments before the due date of your bill. They will automatically remove money from your credit card accounts if you do not comply.

Creating an Afterpay account is simple. All you need to do is provide some basic personal information such as your name, address, credit card number, mobile number, date of birth, and email address to get started.

Afterpay will not subject you to a credit check and you will not be required to provide your Social Security number. You’ll be granted a minimal spending limit after your account has been set up.

Most new accounts begin with a $500 credit limit, which gradually climbs over time based on how you use the account and whether or not you make on-time payments.

Although it does not charge interest, it does charge a late fee, and your account will be suspended for future purchases until your payments are received in full. You’ll also be required to pay in four installments over six weeks.

Explore more apps similar to Afterpay here.

4. Country Door

Unlike Zebit, Country Door is a major web-based online shopping platform that offers many innovative options to its consumers, including purchasing home design products and having them delivered to their doorstep for free.

A user-friendly interactive smart interface, a beautiful graphical layout, and the ability to read the backstory of each item are all provided by the site’s capabilities.

The Buy Now, Pay Later platform provides an opportunity for entrepreneurs to launch their businesses and combine their operations under a single platform.

Thanks to the interaction module, this platform is simple to use. The sign-up function allows you to integrate your account with the newsletter and receive an email alert whenever a new bargain is available on the platform.

It also gives you the option to purchase the item on credit and pay for it every month.

5. Klarna

Klarna is a Swedish firm with operations in a few other countries, including the United States. It provides various online financial services, such as direct payments, post-purchase payments, and payouts for online stores, among other things.

Its primary focus is on providing payment solutions to businesses in the eCommerce industry. It is designed to ensure the safety and security of payments for both vendors and purchasers by handling shop claims and purchaser payments.

By providing clients with pay after delivery, direct payment, and installment plan alternatives, Klarna improves their shopping experience. Compared to Zebit, Klarna customers can pay whenever convenient for them. Klarna accepts payments using a mobile application or a website.

You can choose from three different financing options during your purchase: pay in four days, pay in 30 days, or a loan ranging from six to 36 months.

Your purchase history, refund processing, and shipping tracking are available through the mobile application. Users may create a wish list of things for use in future purchases or for sharing with family and friends.

There is no interest charged as long as you make your payments on time.

Explore more apps like Klarna.

6. Perpay

Users of Perpay may purchase things and pay for them over time using a straightforward scheduled payment system that charges no fees and no interest.

After your purchase has been accepted, most items are sent within three to five business days. Larger items such as furniture and other major appliances, on the other hand, are normally delivered within three to four weeks of purchase.

Perpay may request your personally identifiable information such as your name, home address, email, Social Security Number, contact number, and financial details such as your income, work status, and bank account information.

To qualify, you must have an active mobile phone, be employed full-time, and earn a minimum of $15,000 per year.

Once you’ve finished setting up your profile, you’ll be given an approximate spending limit to work with.

Paid by direct payroll deposit, payments are received per your pay cycle, weekly, fortnightly, or monthly depending on your preference.

Extra payments can be made using a credit card or approved bank account other than payroll payments. Once your order has been accepted, you will get detailed information on how to complete your payment.

Check out other sites similar to Perpay.

7. QVC

QVC is an online shopping site that allows you to purchase items conveniently. You may shop on television via live broadcast on this website.

Compared to Zebit, it provides you with an exclusive television-based home-shopping experience.

The consumer can order an item via the QVC website or obtain the item by dialing the number displayed on the QVC television channel. Account sign-up can result in discounts, gift cards, offers, and other benefits.

QVC also displays things that have been popularly searched for by other users. The user’s transactions are saved by privacy protection, which employs many levels of encryption to accomplish this.

8. Affirm

Affirm is a financial lender that provides installment loans to consumers who apply for them at the point of sale to finance a purchase. That makes this site better than Zebit.

First, download the Affirm program from the Apple App Store or Google Play. Then, make a purchase at your favorite retailers, select Affirm at checkout, submit your information, and find out if you have been accepted for a loan or denied approval.

It does not impose any hidden costs or other fees, such as late fees. Nonetheless, if you make on-time payments, it may hamper your ability to shop.

It will deduct payments from your payment card or bank account on a predetermined schedule.

The management of your existing debts is considered when Affirm approves you for a new buy now, pay later services agreement.

You can select the payment plan that best suits you if your loan application is granted and then finalize your loan. Your credit limit is determined by your credit history, financial history with Affirm, and the length of time you have had an Affirm account.

Affirm allows you to select your preferred method of payment. As a result, you can split your purchases into three, six, or twelve equal installments.

Discover some of the best alternatives to Affirm.

9. Midnight Velvet

Midnight Velvet is a well-known Buy Now, Pay Later platform for women’s clothes based in the United States and accessible in most parts of Canada. Compared to Zebit, this site is best for women’s fashion.

One of the most beneficial aspects of Midnight Velvet is that it allows you to purchase things on credit or rent products and pay for them monthly, depending on their requirements.

It allows you to follow the progress of your purchase. Also, it allows you to enter your payment card information on the company’s website once you’ve placed your order.

You can raise or reduce your available credit depending on how much you’ve spent.

It regularly examines in-company payments, active accounts, and external credit history to determine who qualifies for an increase in credit limit.

Don’t forget that making on-time payments might be the most important factor in determining whether or not you qualify for a limit increase.

Following approval for a loan, you will be able to purchase right away and pay off the total in as little as 47 months with reasonable monthly payments.

You may be required to pay a percentage of the entire amount of your order before it is sent if there is a problem with your past credit performance or your order is significant enough.

10. Ginny’s

Ginny’s is one of the greatest kitchen-promoted websites available, with many recipes.

Unlike Zebit, videos of various commodities are available on the site. It gives the most prominent features for you to communicate with other users and place orders for products.

The most important parts of Ginny’s are the secure interaction, making payments as little as $10 per month if you are purchasing it with credit, the full-contact support option with a live person, and many more features.

Ginny’s offers online catalog sales and allows you to make payments in a secure environment while protecting your information from third-party and hacker intrusions.

The product reviews are shown next to the product to encourage consumers to purchase the item. The sign-up process is simple, and you are not required to provide your financial information during the sign-up process.

It is completely free for all users, although the services are not available to those in developing nations.

Also Read: Best Cash Advance Apps Like Dave

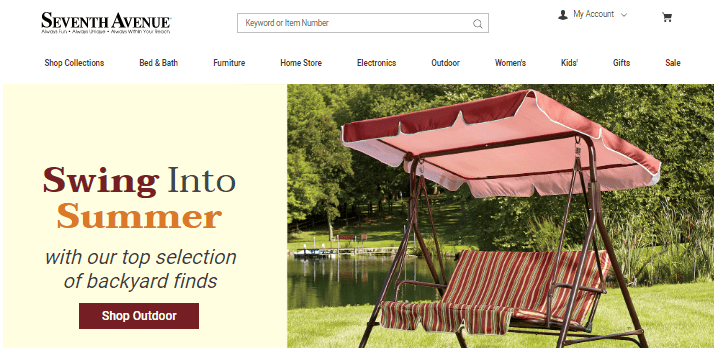

11. Seventh Avenue

Seventh Avenue is a top-rated BNPL platform that provides home décor and the most basic household supplies. It is only accessible in the United States and a few provinces of Canada, and it is quite expensive.

Unlike Zebit, Seventh Avenue has prioritized safeguarding your transaction data from being accessed by a third party throughout the purchase.

Furthermore, it provides you with access to a live person who will assist you with any issues you may be experiencing.

You can raise or reduce your available credit based on how much you have purchased, how much credit you have available, and how much you have already paid.

Once you have been authorized for a loan, you may purchase the item and pay off up to 12 to 47 months with reasonable monthly installments.

You may be required to pay a percentage of the entire amount of your order before it is sent if there is a problem with your past credit performance or your order is significant enough.

Explore: Best Apps Like Albert

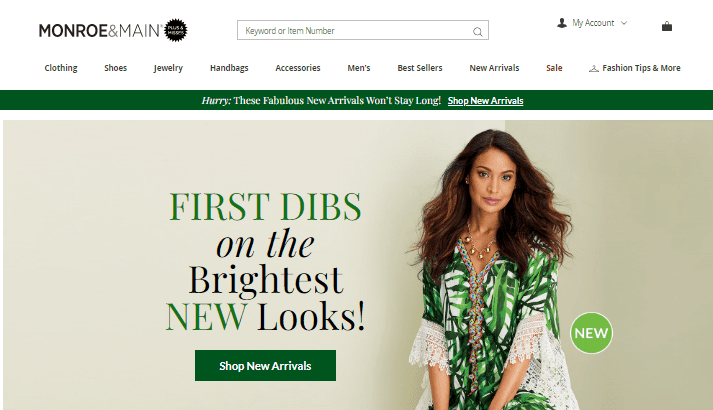

12. Monroe and Main

Monroe and Main is a well-known clothing store that focuses more on women’s apparel than men’s clothing. It is available in the United States and some sections of Canada.

It comprises several modules and numerous items from various companies linked to a single platform, allowing you to quickly navigate through every one of them on a single website.

Among the system’s primary features and functions are the option to purchase items on credit and the ability to rent items and pay for them monthly or in other ways as determined by the user.

Compared to Zebit, the platform registration is free, and it does not require a lengthy list of credentials. Instead, it needs basic information and the ability to pay with a credit card or PayPal on the signup page.

Monroe and Main provides you with things from various brands, an online catalog, a clearance section, and other bargains and discounts.

The Buy Now, Pay Later platform also provides you with the option of having the merchandise delivered right to your door. The website loads quickly and various encrypted firewalls protect all transactions to ensure their security.

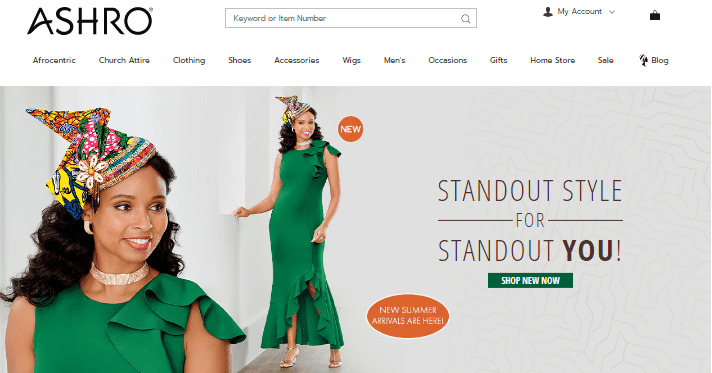

13. ASHRO

ASHRO brings several small companies to operate as a unified store and service provider from a central location.

The site’s primary role is to provide a web-based service through which all of the aspects are seamlessly combined. It allows you to select things and have them delivered to your door.

In certain cases, the monthly payments might be as low as $20 per month, depending on how your application is assessed.

Unlike Zebit, no national or state-chartered banks are involved in providing ASHRO credit, which is given to you directly. It primarily provides credit to individuals who may not be eligible for standard bank or retail credit cards, such as students. There are no third-party costs as a result of this.

You can raise or reduce your available credit based on how much you have purchased, how much credit you have available, and how much you have already paid.

It regularly monitors in-company payments, active accounts, and external credit history to determine who qualifies for a credit limit increase and who does not.

If there is a problem with your prior credit performance or if your order is substantial enough, you may be required to pay a percentage of the entire amount of your transaction before it can be processed.

The monthly payment price is calculated based on the product price plus shipping and processing charges. Your payment is due no later than 25 days following the end of each billing period.

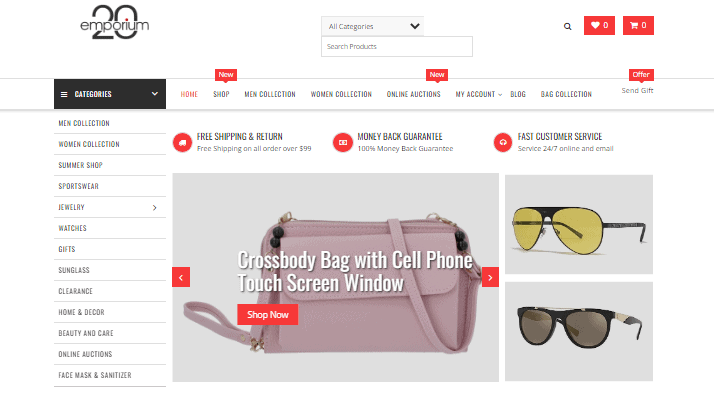

14. Emporium 20

Emporium 20 is one of the most popular sites similar to Zebit. As a direct seller, it can provide you with a one-stop solution for all of your requirements. You can acquire things at low costs on small monthly payments compared to Zebit.

The possibility to choose from tens of thousands of different goods will be accessible to you. A wide range of buying categories is available, including apparel, appliances, electronics, household items, etc.

Any relevant taxes and non-refundable shipping charges are included in the initial payment, including the upfront amount of your transaction and all applicable taxes and shipping charges.

Your credit card or another payment method will be charged for the remaining installments at 30-day intervals following your purchase. You have the right to seek a written record of your payments.

Five payments are automatically withdrawn from your debit card, credit card, or PayPal account every month. With the “Closure” of a complete initial payment, but with the cash-flow advantage of spreading the cost, you’ll have the best of all worlds.

If you paid for the complete transaction in one go, the total amount charged to your card would be no more than the amount you paid in installments.

Also Read: Best Apps Like Chime Bank

15. HSN

HSN is a fantastic Buy Now, Pay Later site that offers a wide variety of bargains and promotions that you can find simply on every page of its layout.

HSN is an American-based platform that brings together various companies under a single roof to make them more accessible and effectively promote them.

There are several features and benefits to using the system including fantastic pricing, secured payment information protection, availabilty in every nation, live agent help, and much more.

The design of the Home Shopping Network is dynamic, thanks to the interface, and the interface gives a complete approach to every module featured on the website.

Unlike Zebit, HSN also provides a television network, which is the system’s most important component. It broadcasts all of the product listings in real-time on the network. It has many classifications for things, making it a terrific platform.

Conclusion

Our best pick is Klarna. Apart from the platform being a place where people can go to make purchases, it’s also a payment processor for eCommerce.

They give their users an option to choose how they’ll make their payments.

Cassie Riley has a passion for all things marketing and social media. She is a wife, mother, and entrepreneur. In her spare time, she enjoys traveling, language, music, writing, and unicorns. Cassie is a lifetime learner, and loves to spend time attending classes, webinars, and summits.