If you’ve ever wanted to make a purchase but couldn’t afford the entire amount up-front, then you might benefit from using buy now, pay later services.

BNPL is a short-term financing plan that allows you to spread the cost of your purchase over time after an up-front payment. For the most part, these services don’t charge interest or fees as long as your repayments are made on time.

Sezzle and Afterpay are the two most popular BNPL services currently on the market.

Millions of customers have used their services in the US and other countries. Both companies have a lot to offer to consumers and retailers. Not only do they make it easier to make larger purchases, but they also help users build up their credit in a responsible way.

Retailers benefit from increased cart conversions, higher average order value, and more repeat customers. Furthermore, merchants get paid upfront which means decreased risk of chargebacks and fraud.

Since Sezzle and Afterpay are two different companies, it stands to reason that they each offer unique services to their customers. It’s important to know them to find out the better platform.

The better platform between Sezzle and Afterpay is Sezzle. To find out why I am saying so, read on. I’ll discuss everything from setup to features, similarities, differences, pros, cons and more.

- Sezzle vs Afterpay: Introduction

- Sezzle vs Afterpay: Setup

- Sezzle vs Afterpay: Features

- Sezzle vs Afterpay: Ease of Use

- Sezzle vs Afterpay: Integrations

- Sezzle vs Afterpay: Security

- Sezzle vs Afterpay: Pricing

- Sezzle vs Afterpay: Pros and Cons

- Sezzle vs Afterpay: Similarities and Differences

- Verdict: Sezzle vs Afterpay – Which Is Better?

Sezzle vs Afterpay: Introduction

What is Sezzle?

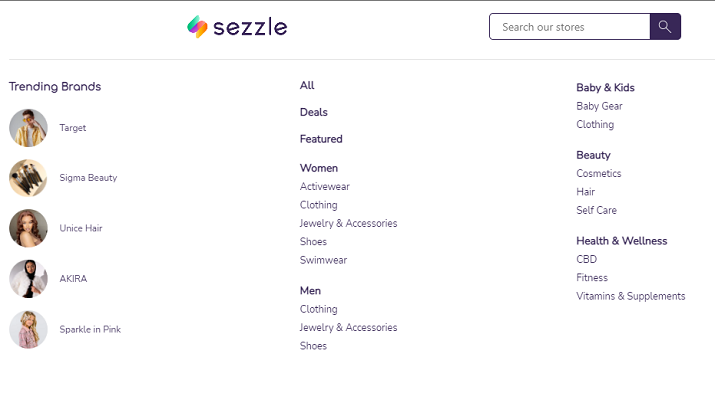

Sezzle is a high-rated buy now, pay later (BNPL) platform that operates in the US and Canada. The company offers an interest-free alternative payment solution for selected online stores.

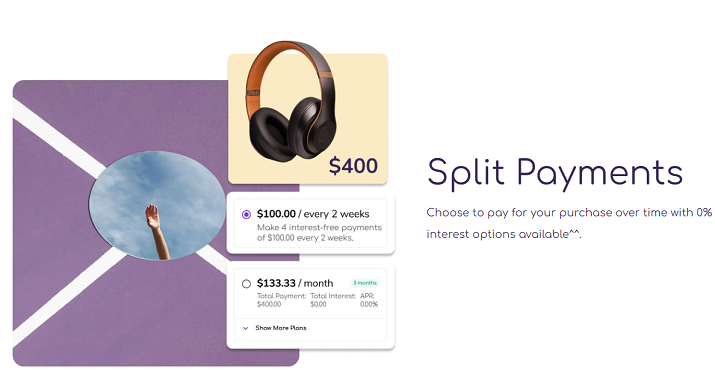

You can purchase your goods as usual, and then pay the amount in four installments with 0% APR.

This publicly traded company is committed to providing an easy way for consumers to build up their credit while managing debt.

You can split any purchase into four manageable payments, one of which is due upon purchase. The other three can be made at two-week intervals, which means you essentially get a free six-week loan – as long as all your payments are made on time.

Also Read: Best Sites Like QVC

What is Afterpay?

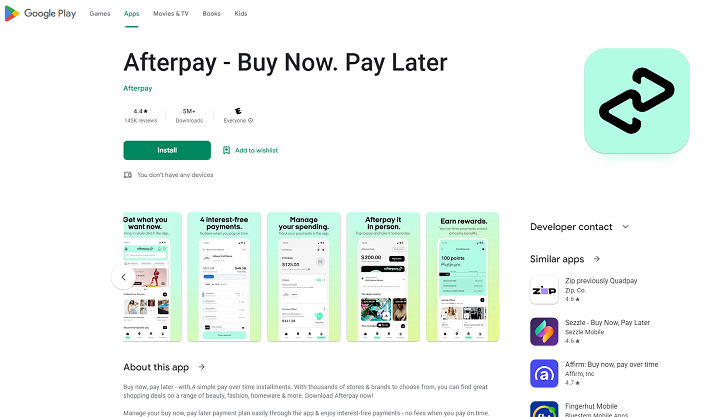

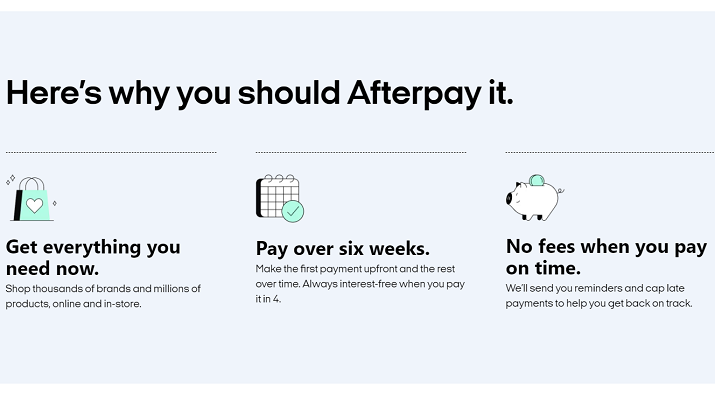

Afterpay is a financial technology company that offers a buy now, pay later (BNPL) service. It’s based in Australia and operates in Australia, the United States, Canada, and the United Kingdom. In the EU, the company is known as Clearpay.

Like Sezzle, Afterpay aims to make it as easy as possible for users to budget their spending and achieve financial wellness.

The service is fully integrated with multiple stores, making it available at checkout as one of your payment options. You can shop as usual, and pay for your purchase with four simple, interest-free installments over a period of six weeks.

There are thousands of brands to choose from, many of which offer great shopping deals on a regular basis. You can also gain rewards as you shop. On average, the platform approves 90% of customers to shop with the BNPL service, making it a great choice for shoppers who want a quick and easy way to access the things they want and need.

Sezzle vs Afterpay: Setup

Sezzle

To get started on Sezzle, simply click “Sign Up” on the website. Enter your mobile number to sign up or log in.

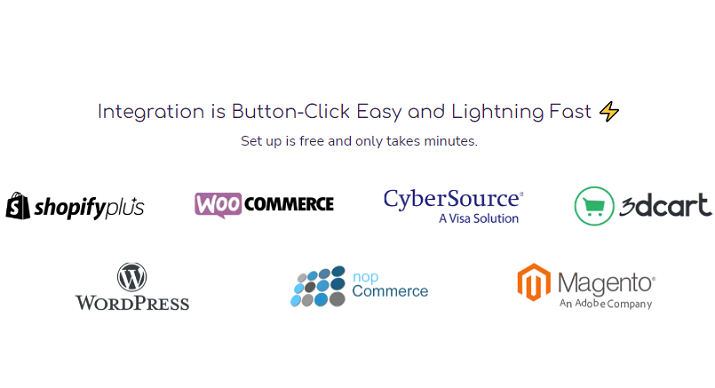

The setup is free. Integration for merchants is as easy as clicking a button. It’s lightning fast and you’ll be up and running and ready to boost sales in just a few minutes.

The platform integrates with apps like Shopify, WordPress, WooCommerce, 3DCart, BigCommerce, SalesForce, and many others.

If you need help at any stage of the onboarding process, you can reach out to support via email or chat and they will be happy to assist you.

Afterpay

Setting up Afterpay is just as easy as its competitor. All you need is your email, phone, address, DOB, and debit/credit card.

Visit the Google Play store to get the app. Follow the prompts to set up your Afterpay Card. You’ll now have access to all the perks for online and in-store shopping at your favorite stores.

When paying in-store, simply tap your Afterpay Card to complete your purchase. You can use the app to browse products and buy what you want to start enjoying it right away.

When using the app, you can see how much you can spend at each store. The platform’s transparent spending limits mean that you’ll know exactly what you have available so that nothing is left behind at checkout.

Also Read: Best Sites Like Zebit

Sezzle vs Afterpay: Features

Sezzle

Sezzle offers a range of features and integrations that make it easy to budget your spending and manage your bi-weekly payments comfortably. Here’s a look at what you get when you sign up for this service.

Sezzle App

The app lets you curate all your favorite stores and products from 47K+ unique brands. You can use it to explore and shop directly from the app (whether online or in-store) to streamline the entire experience.

For example, you can easily tap and pay in-store using your Virtual Card. The app also allows you to manage your purchases and receive notifications. View existing orders, reschedule payments, or change payment methods – you can do it all from one convenient place.

Access Exclusive Deals

Sezzle offers exclusive in-app deals including travel giveaways, discounts, coupons, and more. You can shop top brands by category, such as women, men, home, accessories, etc. Alternatively, you can browse your favorite stores to see what deals are available to you.

Build Credit

Sezzle Up allows you to build up your credit easily. It works whether you’re just starting out on your credit journey, or if you need to rebuild your credit. The company prides itself on offering comprehensive financial education for users to budget and spend their money responsibly.

Check Out: Best Sezzle Alternatives

Integration With Top Brands

You can shop at your favorite stores and buy your favorite products online and in-store thanks to the platform’s easy integration with some of the top brands. Get even more deals when you use the Sezzle app.

Brands include:

- DoorDash

- Target

- Ruumur

- Bass Pro

- Luvmehair

- Sportsman’s Guide

- SoftMoc

- Walker Rose Boutique

…and many others.

Sezzle for Business

If you run a business, you can leverage this powerful platform to help you get more buyers and boost sales.

According to some common results showcased on the website, Sezzle partners experience a 22% average order value lift.

Stores that partner with the platform also see benefits like an increase in the average share of checkout and average approval rate. By allowing customers to split payments, you make it easier for them to make larger purchases.

Certified B Corp

Sezzle is the only company in the BNPL space with B-Corporation certification. The platform aims to financially empower users by partnering with socially-conscious brands and offering easy payments with a purpose.

Partnerships

Sezzle offers revenue-sharing and co-marketing opportunities to help merchants drive new mutual business and sell more.

Partners include all types of businesses, including agency, consultancy, community, and non-profit organizations.

Afterpay

Like its counterpart, Afterpay also empowers customers to get the things they want while still maintaining financial control by splitting payments into four easy installments. Below, we take a closer look at some of the platform’s most prominent features.

Also Read: Best Sites Like Flexshopper

Afterpay App

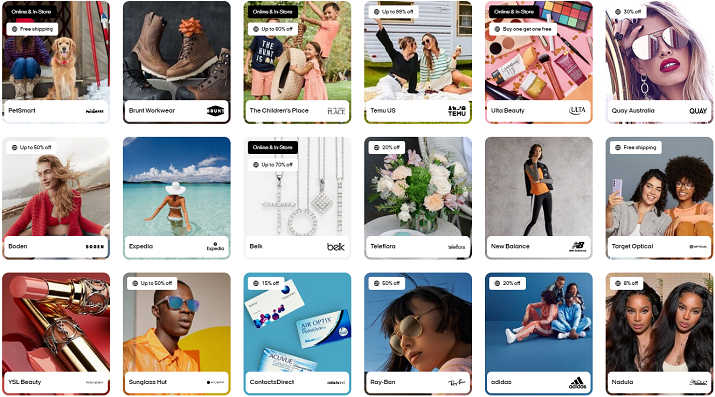

The Afterpay app lets you discover thousands of stores and brands with millions of products both in-store and online.

Whether you are looking for a specific product or you just want some inspiration, there are millions of products waiting for you to search, browse, and pay for in easy, affordable installments.

The app makes it easy for you to discover great shopping deals across a range of products, including beauty, fashion, sporting, homeware, and more.

You can easily manage your BNPL payment plan through the app and enjoy comfortable, interest-free payments when you make your payments on time.

Manage Your Spending

Afterpay makes it easy to stay in control of your spending by allowing you to track payments, reschedule payment dates, and keep your budget in check. You can do all of this and more from your dashboard or app.

Afterpay split payments give you the option to pay for your purchases over a span of six weeks and there’s a 0% interest option available.

Merchants can leverage this technology to create a smooth eCommerce experience for all their customers, particularly those making larger purchases.

Get Lucrative Deals

Explore trending products and get personalized recommendations when you use the app. You also get exclusive deals from top brands and you can even create a shopping list for later.

Some of the top brands offering deals on this app include:

- Macy’s

- Fanatics

- Nike

- Columbia

- Under Armour

…and many others.

You can shop deals according to relevance, newest, or most popular. Alternatively, you can use the search feature to find your favorite brands, products, or stores.

Also Read: Best Apps Like Afterpay

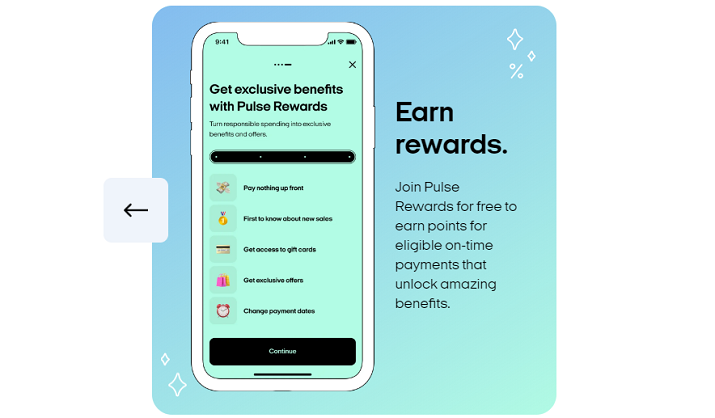

Earn Pulse Rewards

The Afterpay app lets you tap into exclusive benefits with Pulse Rewards, a leading BNPL loyalty program that rewards users for making payments on time.

You can join the program for free to turn responsible spending into amazing benefits and offers that are exclusive to this platform. Whenever you purchase something, you earn points for each eligible on-time payment.

The app makes it easy to manage your account. You’ll be able to see your points, rewards, and progress saved in the app for your convenience. You can choose when and where you use your rewards.

The more points you get, the more rewards you unlock, such as:

- Early access to discounts and sales from your favorite brands

- Purchase gift cards from top brands using Afterpay

- No payment required up-front for future in-store or online purchases

- Delay payment for up to seven days (three or six times per year, depending on your points)

Streamline Your In-Store Experience

Afterpay allows you to easily pay in person with safe, contactless payments. Simply tap to pay, and the same rules apply – whatever you buy, you can pay for in easy installments.

To use this payment method, you first have to set up the digital Afterpay Card in the app.

Navigate to the “In-store” tab and follow the easy prompts to add the card to your Google Wallet or Apple Wallet.

No Credit Rating Impact

If used responsibly, Afterpay won’t affect your credit rating. All you have to do is make your payments on time and your credit history will not be affected in any way.

However, you should note that the company’s fine print says that they have the right to report negative activity on any account to ratings bureaus.

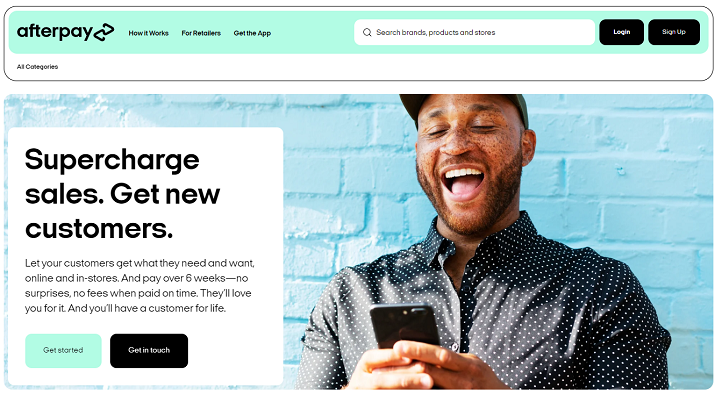

Afterpay for Merchants

As a retailer, you can bring in more foot traffic and supercharged sales by offering Afterpay as an additional payment method at checkout.

This service will allow you to provide a more customized buying experience which will also bring more interest from the platform’s massive base of registered shoppers who may already be eyeing products similar to the ones you sell.

To get started, simply register an account on the website and provide all your details, including things like:

- Your country of operations

- Your eCommerce platform

- Your industry

- How you would like to offer the credit service (whether in-store or online)

…and so on.

Once you’re set up, you can get started leveraging this powerful platform for your business.

Also Read: Best Apps Like FloatMe

Here are some of the main benefits for merchants:

- Get Paid Upfront: You’ll get your payment within days of the purchase, which means you don’t have to wait for the customer to make the full payment.

- Minimize Your Risk: Afterpay takes on all the credit risk, including fraud, chargebacks, and more, leaving you to focus on running your business.

- Daily Settlement Reports: Receive access to important transactional information to reconcile and verify orders.

- Powerful Marketing Engine: Afterpay has a digital store finder and social channels to activate a base of customers that merchants can tap into.

- Impactful Team Training: The platform makes it easy for you to prep your team with tools to help you get the most out of Afterpay.

Sezzle vs Afterpay: Ease of Use

Sezzle

Whether you want to use Sezzle as a customer or merchant, you’ll find the platform extremely easy to use.

Simply download the app from the Play Store or App Store. Follow the prompts to start browsing, buying, getting deals, and managing your orders.

You can request a demo on the website to see how this powerful platform can work for you. Simply contact sales and one of the platform’s experts will get back to you with more information on how Sezzle works.

Afterpay

To get started with Afterpay, simply use your email to create a new account.

Download the app and follow the prompts to log in and as soon as you’re approved, you’ll have access to all your favorite brands and products.

Also Read: Best Apps Like Earnin

Sezzle vs Afterpay: Integrations

Sezzle

Sezzle offers effortless integrations and innovative solutions to help merchants grow and provide a seamless consumer experience on the platform.

Integrations include:

- Lightspeed

- Gorgias

- Ecwid

- ShopifyPlus

- Prestashop

- CommerceV3

- Climate Neutral

- UltraCart

- Bold Cashier

- B Lab

- PunchMark

- Lacore Payment Services

- Klaviyo

- ShipBob

- TrustPilot

Afterpay

Afterpay integrates easily with all major eCommerce platforms, POS systems, terminal APIs and payment gateways. You can be up and running within minutes, and the platform’s tech support team is available to assist you each step of the way should you require it.

Whether you run a brick-and-mortar business, an online store, or both, you’ll find all the integrations you need, including:

- Adyen

- Stripe

- Magento

- Commerce Cloud

- WooCommerce

- BigCommerce

- Shopify

- Ecwid

- Squarespace

- PrestaShop

- Acadaca

- Spree

- Workarea

If your eCommerce platform is not listed, you can make use of the platform’s bespoke integration solutions for businesses that have their own developers.

Contact support to see if you qualify and if you can use the NFC solution which is compatible with all point-of-sale systems for your in-store purchases.

Also Read: Best Fashion Websites

Sezzle vs Afterpay: Security

Sezzle

Sezzle takes its security and compliance seriously. The company is PCI DSS Level 1-Certified which means that an external auditor has been brought in to fully assess the organization’s ability as a financial services provider.

The PCI DSS certification is a set of standards released by the PCI SSC – Payment Card Industry Security Standards Council. This is to increase cardholder data security.

It ensures the safe handling, processing, and storage of credit card information and other sensitive customer data.

The company goes even further to protect merchants by helping them implement technologies according to approved considerations so they can delegate their PCI DSS responsibilities to Sezzle.

Afterpay

Like Sezzle, Afterpay takes appropriate measures to secure sensitive customer information. This includes administrative, technical, and even physical safeguards that guard against loss, theft, and misuse of personal information.

Afterpay is an ISO 27001-compliant company and it requires its third parties to meet appropriate security standards when handling customer data on the company’s behalf.

Sezzle vs Afterpay: Pricing

Sezzle

This in-demand payment option is free for customers to use. Retailers can get a quote by contacting support.

Afterpay

Afterpay’s fantastic payment plan is free to use and also has quote-based plans for merchants.

Sezzle vs Afterpay: Pros and Cons

Sezzle

Pros

- Easy Payments: With Sezzle, you can purchase what you want right now and pay for it in four easy installments over a period of six weeks.

- Zero Risk: The company assumes all the credit risk, which means merchants don’t have to wait until the customer pays in full to be paid.

- Simple to Launch: Customers and merchants can launch Sezzle and be ready to go in just minutes.

- Fast Approval Decisions: Sezzle makes instant approval decisions as soon as you sign up so you don’t waste any of your precious time waiting on your purchase.

- Certified B Corp: Sezzle’s social and environmental performance is unmatched in the industry thanks to the company’s commitment to empowering consumers through financial education and payments without interest or fees.

Cons

- Not Everyone Gets Approved: Sezzle’s system doesn’t approve 100% of orders and sometimes customers get denied.

Check Out: Best PriceSpy Alternatives

Afterpay

Pros

- Ease of Use: This fast-growing service is an easy-to-use option for millions of shoppers in Australia, the US, Canada, and the UK.

- No External Credit Checks: More shoppers sign up with Afterpay than other payment services because the platform doesn’t conduct credit checks or charge application fees.

- Larger Purchases: Afterpay allows customers to split their payments, which directly contributes to larger orders.

- Robust Technical Support: Afterpay offers comprehensive tech support for everything from initial setup to integrations and ongoing maintenance.

Cons

- High Late Fees: If you miss a scheduled payment, you’ll incur late fees of up to $68 or 25% of the purchase price (whichever is lower).

- No Credit Rating Impact: While this might be considered a “Pro” it actually means that even when you use the service responsibly, it’s not helping your credit rating.

Also Read: Best Sites Like ASOS

Sezzle vs Afterpay: Similarities and Differences

Below are some of the similarities and differences between these two popular financial products.

| Sezzle | Afterpay | |

| User Base | Everyone | Everyone |

| Easy Setup | Yes | Yes |

| Financially Empowering | Yes | No |

| Powerful Integrations | Yes | Yes |

| Robust Security | Yes | Yes |

| Free to Use | Yes | Yes |

| Mobile App | Yes | Yes |

| Wide Range of Brands | Yes | Yes |

| Risk-Free Management | Yes | Yes |

| Reporting | No | Yes |

Verdict: Sezzle vs Afterpay – Which Is Better?

Both Sezzle and Afterpay are great financial products that lend you a certain amount of credit to pay for your purchases. You pay back the amount over four installments every two weeks. When you make your repayments on time, you can avoid paying additional fees.

This makes them handy products not only for consumers but also for merchants who see an instant boost in sales by adding this risk-free service that can help turn browsers into actual paying customers.

But, after a detailed comparison, I’m of the opinion that Sezzle is the better BNPL provider on the market right now.

It’s the highest-shopper-rated solution and the company financially empowers consumers and partners with best-in-class payment processors and tech solutions. It allows consumers to build credit slowly and responsibly without taking on too much debt.

Tom loves to write on technology, e-commerce & internet marketing.

Tom has been a full-time internet marketer for two decades now, earning millions of dollars while living life on his own terms. Along the way, he’s also coached thousands of other people to success.